A Few Things to Consider for April 15th

It’s tax time.

One. Two. Three. Four.

Let me tell you how it will be. There’s one for you and 19 for me.

You know where this is going. If not, you should consider adding more Beatles to your musical diet. He’s the Taxman—and dear friends, the Taxman cometh.

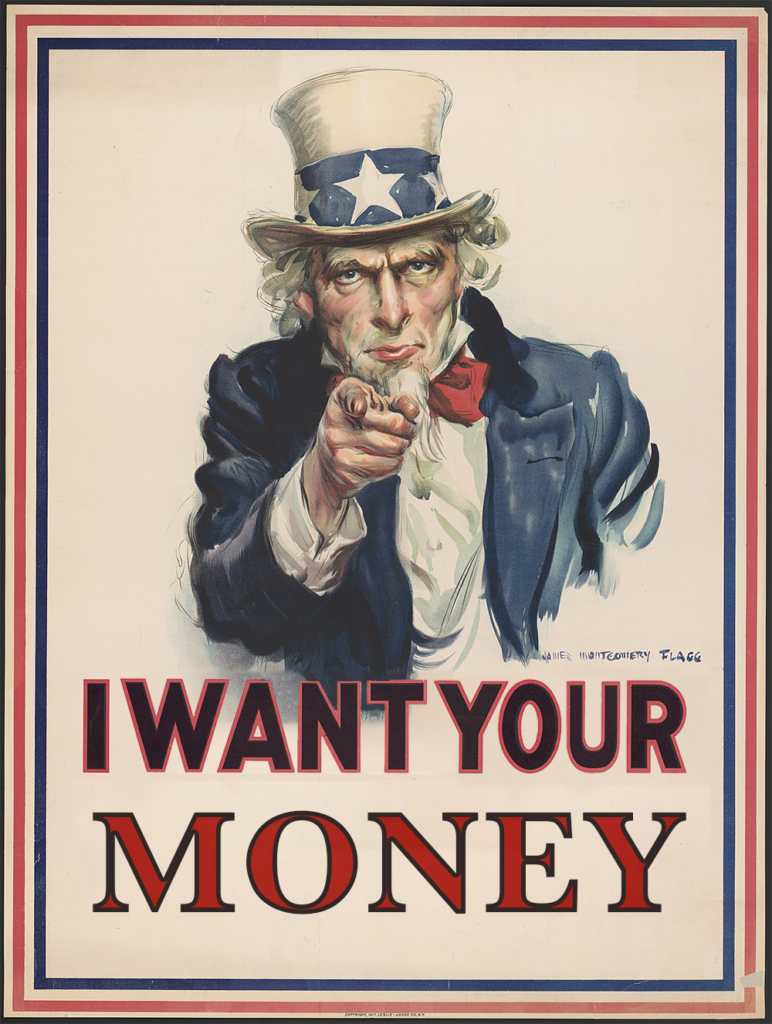

Tax season is almost upon us, which means that we need to get cracking on all that prep work. Truth be told, if you’re a business owner, you should have been prepping all year, but the dangers of procrastination are another subject for another day. For now, let’s get our brains in tax mode by going over some of the broad strokes that you’ll need to keep in mind when ol’ Uncle Sam comes for his 19 out of 20.

Section 280E: Vestige of the Reaganite Drug Warriors

Let’s talk briefly about IRC Section 280E, a statute that probably has nothing to do with you, but also might have everything to do with you. In 1982, Congress enacted IRC 280E of the Internal Revenue Code to punish businesses engaged in illegal drug trafficking, including cannabis. Under this statute, businesses involved in the trafficking of Schedule I or Schedule II controlled substances, as classified by the Controlled Substances Act, are limited in the deductions they can claim on their federal income tax returns. Cannabis falls under Schedule I, and this section directly impacts cannabis businesses. Cannabis operations can pay an effective tax rate of 60 – 80% more than their neighboring non-cannabis business because of this archaic code limiting them to claim only Cost of Goods Sold (COGS) related deductions.

But here’s the good news, for those simply on the accessory side—as in those who do not directly grow, sell, or traffic cannabis, but only sell related accessories—which is most of us, the implications of IRC Section 280E are different. Since your business is not dealing with the controlled substance itself, you are generally not subject to the limitations of Section 280E. This means you can typically deduct ordinary and necessary business expenses under IRC Section 162. Hooray! Pop the champagne!

Hold on. Don’t pop that bubbly just yet. There’s a lot more to go over and still a helluva lot more paperwork to fill out. Read on for a few more bits and pieces that might make this painful time of the year a little less . . . well . . . painful. (See Sidebar 1 for more info on IRC Section 280E.)

Delta 8 and IRC 280E: Is There a Problem?

While IRC Section 280E doesn’t apply to accessories or the various other peripherals of the industry, its application to Delta 8 products is a legal gray area for the ages. Let’s pick this apart and see if we can’t make a little sense of it.

As we know, per the current iteration of the Farm Bill, all derivatives and extracts of hemp are legal—and hemp is defined as any cannabis plant with a Delta-9 THC concentration of no more than .3% on a dry weight basis. Therefore, Delta-8 is technically legal to buy and sell, so long as it is derived from the hemp plant. It’s practically an industry catechism at this point.

However, this past August, Marijuana Moment reported on a 2021 email from Terrance Boos, chief of the DEA’s Drug and Chemical Evaluation Section. In the email, Boos specifically stated, “Any quantity of Delta-8 THC obtained by chemical means is a controlled substance.” Now, this was written prior to the DEA’s statement made a year ago in which they announced that Delta-8 & 9 THCO were officially recognized as Schedule 1 substances, so perhaps that’s as far as the statement covers.

However, it should be noted that Delta-8 THC occurs naturally in the plant at such miniscule levels that virtually any Delta-8 product on the market is likely produced by converting CBD through a chemical process. According to Boos, “That act of taking that substance in any synthetic step now brings it back under the CSA.”

So, although THCO has been the only category of hemp cannabinoid specifically named by the DEA, it appears that the agency is still of the mindset that most of the Delta-8 currently on the market would be considered a controlled substance.

Should the IRS follow this guidance in their definitions, it would mean devastating consequences for anyone involved in the sale of Delta-8, which is almost everyone here. Chances are nothing will happen, and we’ll all come out the other side unscathed. But the mere possibility is all the more reason why you should always consult with a professional—and not just any professional, but one who is well-versed in the nuances of our quirky little corner of commerce.

Expense Categorization: Direct vs. Indirect

Direct expenses are those costs that are directly attributable to the production of goods sold. For your business, this most likely includes expenses incurred in acquiring products like glass, pipes, vaporizers, hemp consumables, etc. These are considered the Cost of Goods Sold (COGS) and are crucial for your tax calculations because, even under Section 280E, COGS can be deducted.

In contrast, indirect expenses are the general overhead costs that are necessary for running a business but are not directly tied to your operations. Examples include rent, utilities, general office supplies, and marketing costs. It’s here that Section 280E poses a significant challenge for cannabis-related businesses. But remember, this limitation does not apply directly to accessory businesses; only those businesses involved in handling the plant itself—specifically, the variation of the plant still governed by the CSA (meaning, not hemp.)

Navigating the State and Local Tax Maze

Next, let’s look at state and local tax laws for a moment. In states where cannabis is legal, the tax regime is a gray sky jigsaw puzzle with pieces from both federal, state regulations and often even municipal regulations.

Meanwhile, you’re probably not just selling cannabis accessories. Most shops in our little corner of commerce are deeply involved with the sale of various tobacco products as well, and that’s where it gets really tricky.

True story: Head shop owners have spent a night or two in jail over unpaid tobacco tax revenue that could have been covered by digging under their couch cushions. Why? Simply because they didn’t realize they needed to pay it. Point is, you have to do your homework.

Our tip? Be wary of companies claiming the taxes on the products they offer are prepaid and always keep a keen eye on these ever-changing rules, because the rules . . . they are a’changing. Most importantly, regularly consult with a tax expert too. Remember, there are only two certainties in this great country: death and taxes. Aww…did you think I was going to say freedom? That’s adorable.

The lost art of Record Keeping

Think of record-keeping as your reserve (second) parachute. Those well-organized files and records are your best friends when it comes to justifying those all-important deductions and bracing for the ‘just in case’ scenario of audits. Embrace your inner OCD and keep those records shining! Chuck G. at Vapors in the Bay Area of California underscores the significance of proper record keeping, sharing a teachable moment in the process. “Auditors are often unfamiliar with our business model,” he tells us. “Discrepancies they find are worth contending if you can back up your books.” Best course of action: Hire a bookkeeper, but don’t just assume they’re doing their job. Politely, but firmly stay involved. If they drop the ball, it’s your ass, not theirs.

Stay in the Loop

The cannabis/head shop world is always evolving, and so are its laws and regulations. Keeping up with these changes is not just good practice—it’s crucial for your business’s health. So, keep an ear to the podcasts and an eye on the screen to stay informed about the legal shifts that could affect your tax strategy. Start with reading HQ. I mean, we’re cool and all, but we also know a lot of smart people—and they tell us what to write.

Don’t Skip the Tax Pros

With taxes, a little expert advice goes a long way to keep the IRS auditor away. Consulting with tax professionals who know the ins and outs of the cannabis and accessory industries is like traveling with Gandalf. You can move forward with confidence, you’re less likely to get lost, and you’ll have a much better shot at defeating the Balrog (which in this case is an audit.) You shall not pass and such.

Trent Bohl of Smokey Joe’s West in Silver City, New Mexico, highlights the significance of understanding deductions and the invaluable role of a competent accountant.

“A basic understanding of deductions & having a good accountant is crucial,” he states. Bohl emphasizes the financial benefits of accounting for every deductible, particularly mileage deductions. “At around $.50 a mile, you can really reduce tax burden. My 30k in business mileage dropped my tax liability by $15,000.”

See You Next Year…

In the end, remember this: taxes in the cannabis accessory world are like a box of chocolates – you never know what you’re gonna get, but you can always expect things to get a bit sticky. Keep your wits sharp, your records sharper, and maybe, just maybe, you’ll come out the other side with a few dollars to spare. Stay tax-savvy, my friends!